Bexar Appraisal District 2024 Reappraisals Are Painful For Commercial Property Owners

O'Connor provided an overview of the Bexar Appraisal District's 2024 Reappraisals, revealing unfavorable outcomes for owners of commercial properties.

AUSTIN , TEXAS, UNITED STATES , May 10, 2024 /EINPresswire.com/ -- Key Information about Bexar Appraisal District

The most recent data available indicates that the Bexar Appraisal District will have an annual budget of $20.2 million as of 2022. Their staff of 79 appraisers value around 737,944 taxable properties. Every Texas county has an appraisal district, apart from Potter and Randall, which share one.

Bexar County experiences a nearly 3.5% rise in home tax reappraisals.

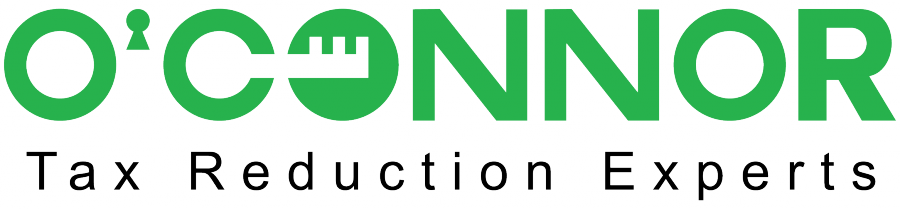

The property tax assessments for residential houses valued at above $1.5 million had the highest increase in Bexar County. The assessments rose from $4.7 billion to $5.2 billion, reflecting a 10.4% increase in market value. In contrast, the smallest rise occurred in the price range of houses valued below $250,000, with a modest increase of just 1.5%. In 2024, the Bexar Appraisal District increased the average assessed value of single-family dwellings by 3.5%.

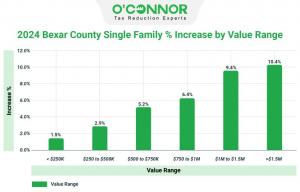

Residential properties measuring between 6,000 and 7,999 square feet had an increase of 10%, from $1.6 billion in 2017 to $1.8 billion in 2024. Also seeing a substantial 9% increase were other, higher-value homes, such as those with an area over 8,000 sq ft. Of all the housing sizes, those under 2,000 square feet saw the least increase of just 2.4% from the prior year. In general, the appreciation in property value for single-family houses in Bexar County was very typical, with a 3.5% increase seen across residences of all sizes.

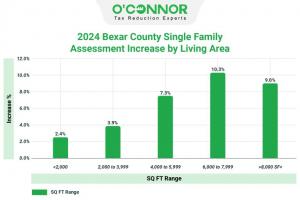

San Antonio Metro Single Family Value Appreciation Compared to Bexar County Assessment Increases

Amidst the 2024 property tax reassessment in Bexar County, the Bexar Appraisal District reportedly increased home values by 3.5%. However, diverging from this perspective, the assessment conducted by the San Antonio Board of Realtors showcased a striking 19.2% decline in actual home prices within the San Antonio Metro area from January 2023 to January 2024.

Bexar County Tax Assessments Based on Year Built

Simultaneously, there was an equal and significant rise of 4.9% in the value of residential properties built in 2001 and through today as well as properties classified as “others” with unspecified construction years. Properties constructed between 1961 and 1980 were observed to have the lowest assessments, namely at a rate of 2%. To summarize, data from the Bexar Appraisal District indicates that home prices in the county collectively had a moderate 3.5% gain, grouped by the year of construction.

A total of 12,513 homes in Bexar County were assessed with an overvaluation, leading to a 50% increase in their worth. Consequently, the sales price of these homes surged from $3.9 billion to the 2024 market value of $4.3 billion. Additionally, the number of residential accounts valued at or below this threshold amounted to 12,451, marking a 50% increase from 2023 to 2024.

Commercial property owners in Bexar County are seeing increases in their tax revaluations.

Within Bexar County, warehouse-related real estate experienced a notable surge, with a remarkable 18% increase from $3.5 billion to $4.1 billion compared to the previous year. Concurrently, hotel owners exhibited steady growth of 6.2% for 2024.

When evaluating commercial properties in Bexar County by year built, those constructed between 1981 and 2000 exhibit the lowest increase in value compared to any other construction year category. Interestingly, a careful observation reveals a surprising increase of 13% for commercial properties falling under the “others” category, despite the lack of recorded construction years in the tax accounts for these properties. It’s worth noting that while the majority of tax accounts include easily available data about the year of construction, this minority of accounts has data missing. Their inclusion in the analysis allows for a more accurate interpretation of the data, preventing inconsistencies in the overall numbers.

Bexar Appraisal District’s 2024 property value estimations differ from Wall Street analysts.

The disparity between the research conducted by Green Street Real Estate company and the 2024 commercial property tax reassessment by the Bexar Appraisal District is notable. According to the district’s assessment, commercial property values escalated by 11.1% over the preceding year.

Assessment of Bexar County Property Taxable Value Increase by Value Range

In the 2024 tax assessment for Bexar County, commercial property values have shown a consistent uptrend across all assessed categories and price ranges. Notably, properties valued between $1 million and $5 million experienced a notable 12% increase from their 2023 market value. Conversely, properties priced below $500,000 saw a more restrained rise, amounting to $195 million from their 2023 value, reflecting a 9.7% increase.

Bexar County Apartment Property Growth by Construction Year

For all apartment complexes in Bexar County, the property tax assessments for 2024 increased by 11%. The largest rise was seen in apartment buildings built after 2001, whose value increased from $13 billion in 2023 to $15 billion in 2024, a 12.8% increase. The least degree of value gain was seen in apartment buildings constructed before 1960, when values increased from $464 million to $498 million, or 7.3%.

Increase in Bexar County Office Building Percentage by Year Constructed

Across all year-built ranges, there has been a notable increase of approximately 10% in property tax assessments, as per the data from the Bexar Appraisal District. Specifically, office buildings categorized as “others,” lacking specified construction years, saw a significant 14.7% surge in their assessments for 2024. Conversely, office buildings constructed between 1981 and 2000 experienced the lowest increase of all at 8.8%. This overall trend indicates a consistent upward trajectory across various construction periods.

Retail Tax Assessments Up About 10%

There’s a clear upward trend in retail building property tax assessments across all construction phases in Bexar County. Retail structures built after 2001 lead the charge, enjoying a significant nearly 11% increase in value, jumping from $3.8 billion in 2023 to $4.2 billion in 2024. The substantial increase of more than 8% in the valuation of individual retail properties in Bexar County when compared to the previous year provides additional evidence of the prosperous commercial environment seen throughout all stages of construction.

Warehouse owners in Bexar County whose buildings were constructed in different years had a significant rise of 18% in their property tax assessment from 2023 to 2024. The value of warehouses constructed in Bexar County after 2001 has risen dramatically. There was a 23% increase, from $2.5 billion to $3 billion, in the worth of these buildings.

2024 Reassessment of Office Buildings by Type in Bexar County

Two particular kinds of office buildings in Bexar County had increases in property tax assessments in 2024. Low rise office buildings had an 11% increase, whereas medical office buildings saw a significantly larger increase of about 12%. The total assessment for 2024 has risen by almost 10%, rising from $8 billion to $8.7 billion.

Property Tax Revaluation of Apartments by Type in Bexar County for 2024

The property tax assessments for high-rise apartment buildings in Bexar County experienced an increase in 2024. The notice market value increased by 14%, from $3.9 billion to $4.4 billion. Similarly, the garden apartment complex had a growth of 11%, going from $17 billion to 19.7 billion.

2024 Bexar County Retail Property Tax Revaluation by Type

In 2024, property tax evaluations for community shopping centers in Bexar County soared by 13%. Among these, lifestyle centers registered a slight uptick of 4.2%, keeping their market value relatively stable from 2023. Meanwhile, Bexar County retail properties enjoyed a noteworthy 10% surge from the 2023 market value.

Bexar Appraisal District Reports 18% Collective Rise in Warehouse Property Values

The Bexar Appraisal District reported a collective increase of 18% in the market values of four warehouse property categories. Notably, mega warehouse buildings experienced a remarkable surge of 28%, skyrocketing from $1.8 billion to $2.3 billion. On the other hand, the mini warehouse category saw the smallest gain in property values, with a modest increase of approximately 6.1%.

Overview of Bexar Appraisal District’s 2024 Property Tax Revaluation

Property owners in Bexar County are seeing significant increases in property values for both residential and commercial properties. Bexar County experienced a more substantial rate of expansion in comparison to the San Antonio metropolitan area.

The gains generated in the commercial real estate sector were significant. The market trends for commercial real estate have posed difficulties for some individuals and proven to be unfavorable for others. It is probable that several owners of commercial properties would admit in private discussions that the worth of their assets has decreased in recent years. The rise in interest rates from 1.71% in January 2022 to 4.05% in January 2024 has contributed to this predicament to some extent. It is also a result of consistent revenue patterns along with significant and ongoing increases in casualty insurance and other operational expenditures.

Appeal Your Property Values Each and Every Year

Property owners in Texas, especially those in Bexar County, have a legal entitlement and would be prudent to challenge the assessed value of their property. Both residential and commercial property owners might choose to provide evidence throughout the appeal process to support their claim that the assessed value is too high. Owners should seriously consider filing an appeal or enlisting the assistance of a property tax consulting firm, since most property tax protests result in positive resolutions. O’Connor has a wealth of expertise of over a period of fifty years in supporting the rights of property owners. l In addition, they have the requisite resources to fulfill their main goal of improving the lives of property owners by efficiently cutting taxes at a reasonable cost.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.